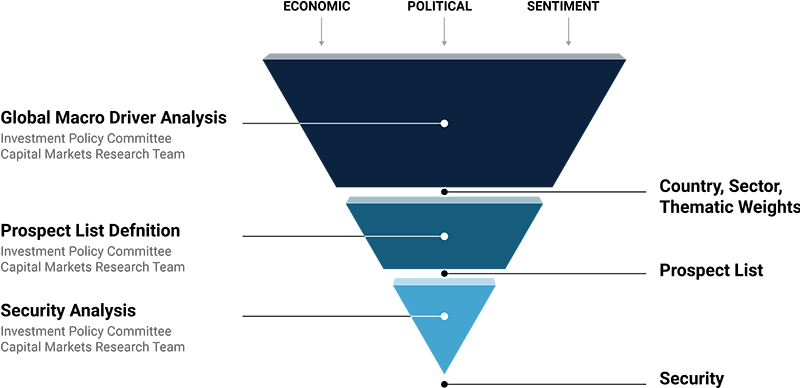

Our Investment Process

Fisher Investments’ top-down investment process first establishes outlooks and develops portfolio themes to emphasise parts of the market we believe will perform best, such as different countries and stock market sectors. We then analyse individual securities and select those we believe best capture macro preferences.

Global Macro Driver Analysis

We analyse a wide range of economic, political and sentiment drivers to formulate forecasts and develop portfolio themes.

Prospect List Definition

Based on Fisher Investments’ macro driver analysis, we identify securities that best capture the high-level themes consistent with the outlook and forecast.

Security Analysis

We conduct fundamental analysis to select securities with strategic attributes that provide competitive advantages over peers.