-

Top-Down Investing

-

Strategies With Global Reach

-

The Advantages of Responsible Investing

-

Who We Serve

-

Personalized Retirement Outcomes

SOUND INVESTMENT EXPERIENCE

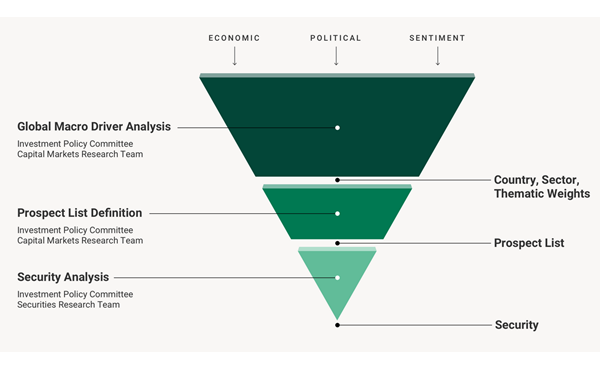

Our Investment Teams

The Investment Policy Committee and our Research Group interact closely to create, implement and continuously monitor our strategies.

Investment Policy Committee

The Investment Policy Committee (IPC) makes all the strategic investment decisions. It draws its expertise from over 150 years of combined industry experience.

Research Group

Our analysts study global trends and developments and produce unique research to support the Investment Policy Committee's portfolio management decisions.

Fisher Investments manages assets on behalf of a wide variety of institutional clients from across the globe, including:

|

Corporate Plan Sponsors |

|

Sovereign Wealth Funds |

|

Public Plan Sponsors |

|

Family Offices |

|

Financial Institutions |

|

Not-for-Profit Organizations |

|

Endowments |

|

Foundations |