Security Selection

Fisher Investments' Security Selection Process Involves:

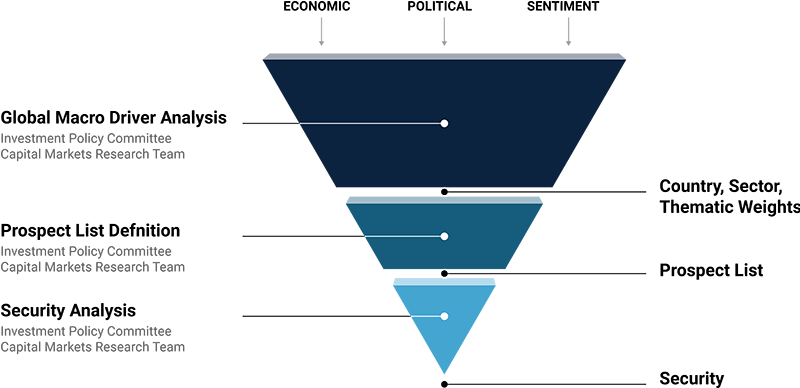

Infographic Long Description 1

The graphic shows an inverted triangle surrounded by text. The widest portion of the triangle is at the top and the narrow point is at the bottom. The graphic symbolizes the investment team’s process of refining a universe of securities down to just those that make up a client’s investment portfolio.

The inverted triangle is separated into three “stages”:

- Global Macro Driver Analysis

- Prospect List Definition

- Security Analysis

Text specifies that the Investment Policy Committee and the Capital Markets Research Team are involved at all three stages.

The top segment (the widest part of the triangle) carries the label “Global Macro Driver Analysis.” Above this portion, three “inputs” connect with arrows: Economic, Political and Sentiment. These represent the three macroeconomic drivers the Investment Policy Committee uses for their analysis.

The “Country, Sector, and Thematic Weights” that result from this Global Macro Driver Analysis feed into the next step: “Prospect List Definition.”

The middle portion of the triangle is labeled “Prospect List Definition.” At the end of this step, the resulting “Prospect List” informs the final portion of the process.

The lowest portion of the triangle carries the label “Security Analysis.” At the bottom of the graphic, the point of the triangle is labeled “Security.” This marks the end of the process, whereby the investment team has identified those investments that represent the best ideas for a client’s portfolio.

Identifying Macro Drivers

Fisher Investments will analyse economic, political, and sentiment drivers to shape portfolio themes and weights. This analysis is applied throughout the individual security selection process.

Prospect List Definition

Basic quantitative screening helps minimise risk and narrow the security prospect list and involves the following steps:

- Screen out any securities with insufficient liquidity or solvency issues.

- Then screen securities based on Fisher Investments’ macro views including valuation and/or style preferences.

- Lastly, conduct an outlier analysis to exclude securities with categorisation, pricing, business activities and/or other characteristics outside of the peer group. This step identifies securities that best leverage Fisher Investments’ higher-level themes.

Strategic Attribute Identification

Fisher Investments seeks firms with underappreciated competitive or comparative advantages relative to peers.

Security Selection

Fisher Investments narrows the prospect list based upon fundamental research, which includes

Strategic Attribute Preferences

Identifying which attributes best leverage Fisher’s portfolio themes.

Attribute Execution Analysis

Determining if the firm’s management has a cohesive, executable plan for exploiting its strategic attribute(s).

Relative Valuation Analysis

Examining current valuations relative to peers, historical trends, and the market.

Operational Risk Assessment

Analysing operational red flags to understand potential risks unrelated to valuations or day-to-day management.

From Opportunity to Reality

The opportunity set for global equities is vast. Learn how Fisher Investments distills the investment universe to build custom portfolios.

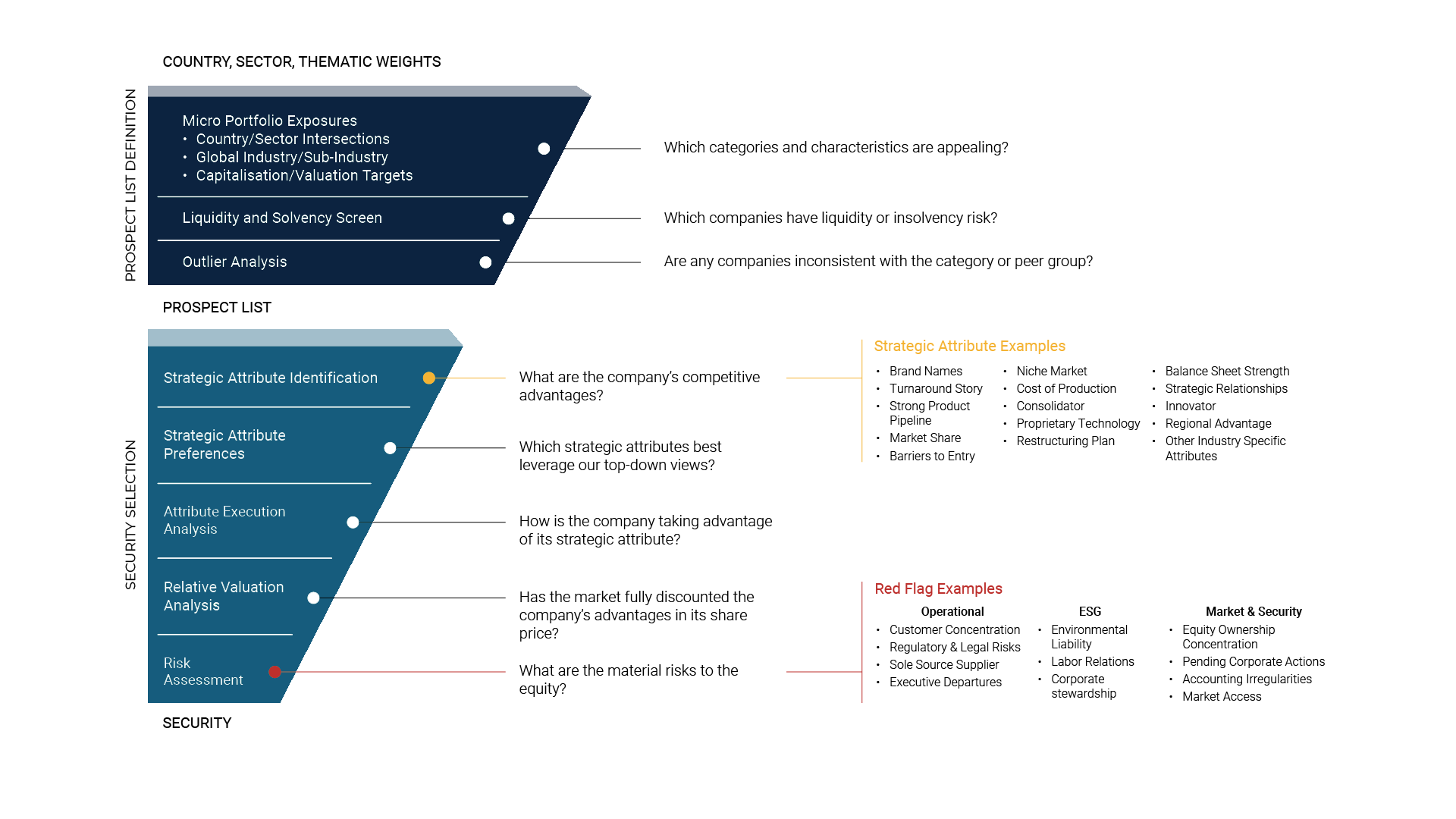

Infographic Long Description 2

This image uses graphic elements and text to communicate the following:

- The steps in Fisher Investments’ investment decision-making process

- The questions the investment team seeks to answer at each step

- The accompanying information they use to answer those questions and arrive at security decisions.

Graphically, a funnel dominates the left side of the image. The funnel is divided into a darker top-third and a lighter bottom two-thirds. Questions and bullet-point lists populate the right-hand side of the image, connected with lines to text inside the funnel.

The upper portion of the funnel shows that the top-down investment process begins with analysis of country, sector and thematic weights to arrive at a list of potential investable securities. A label reading “Country, Sector, Thematic Weights” tops the funnel. Along the side, the label reads “Prospect List Definition.”

The first step in the funnel is “Micro Portfolio Exposures.” It includes three points:

- Country/Sector Intersections

- Global Industry/Sub-Industry

- Capitalization/Valuation Targets.

At this step, the investment team seeks to answer the question “Which categories and characteristics are appealing?”

The next step is “Liquidity and Solvency Screen,” which helps the investment team determine “Which companies have liquidity or insolvency risk?”

The final step of the “Prospect List Definition” portion of the funnel reads “Outlier Analysis.” At this step, the investment team asks, “Are any companies inconsistent with the category or peer group?”

The lower portion of the funnel (Security Selection) comprises five steps. The first step is “Strategic Attribute Identification.” The question answered at this point is “What are the company’s competitive advantages?” A connected bullet-point list details examples of these strategic attributes:

- Brand Names

- Turnaround Story

- Strong Product Pipeline

- Market Share

- Barriers to Entry

- Niche Market

- Cost of Production

- Consolidator

- Proprietary Technology

- Restructuring Plan

- Balance Sheet Strength

- Strategic Partnerships

- Innovator

- Regional Advantage

- Other Industry-Specific Attributes

The second step in the Security Selection portion of the funnel is “Strategic Attribute Preferences.” At this step, the investment team seeks to answer the question “Which strategic attributes best leverage our top-down views?”

The third step is “Attribute Execution Analysis.” Here, the investment team asks, “How is the company taking advantage of its strategic attribute?”

The fourth step is “Relative Valuation Analysis.” The question accompanying this step is “Has the market fully discounted the company’s advantages in its share price?”

The last step is “Risk Assessment.” The accompanying question is “What are the material risks to the equity?” Next to the question are examples of these “Red Flags,” broken out into three main categories: Operational; Environmental, Social, and Governance (ESG); and Market and Security.

- Operational

- Customer Concentration

- Regulatory and Legal Risks

- Sole Source Supplier

- Executive Departures

- ESG

- Environmental Liability

- Labor Relations

- Corporate Stewardship

- Market and Security

- Equity Ownership Concentration

- Pending Corporate Actions

- Accounting Irregularities

- Market Access

At the bottom of the lower portion of the funnel is the label “Security.”