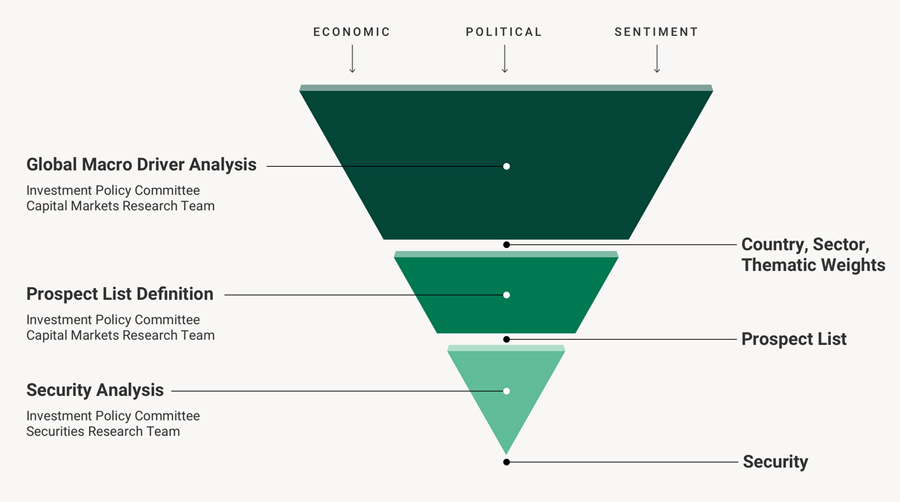

Security Selection

Our Security Selection Process Involves:

Identifying Macro Drivers

We analyze economic, political and sentiment drivers to shape portfolio themes and weights. We apply this analysis throughout the individual security selection process.

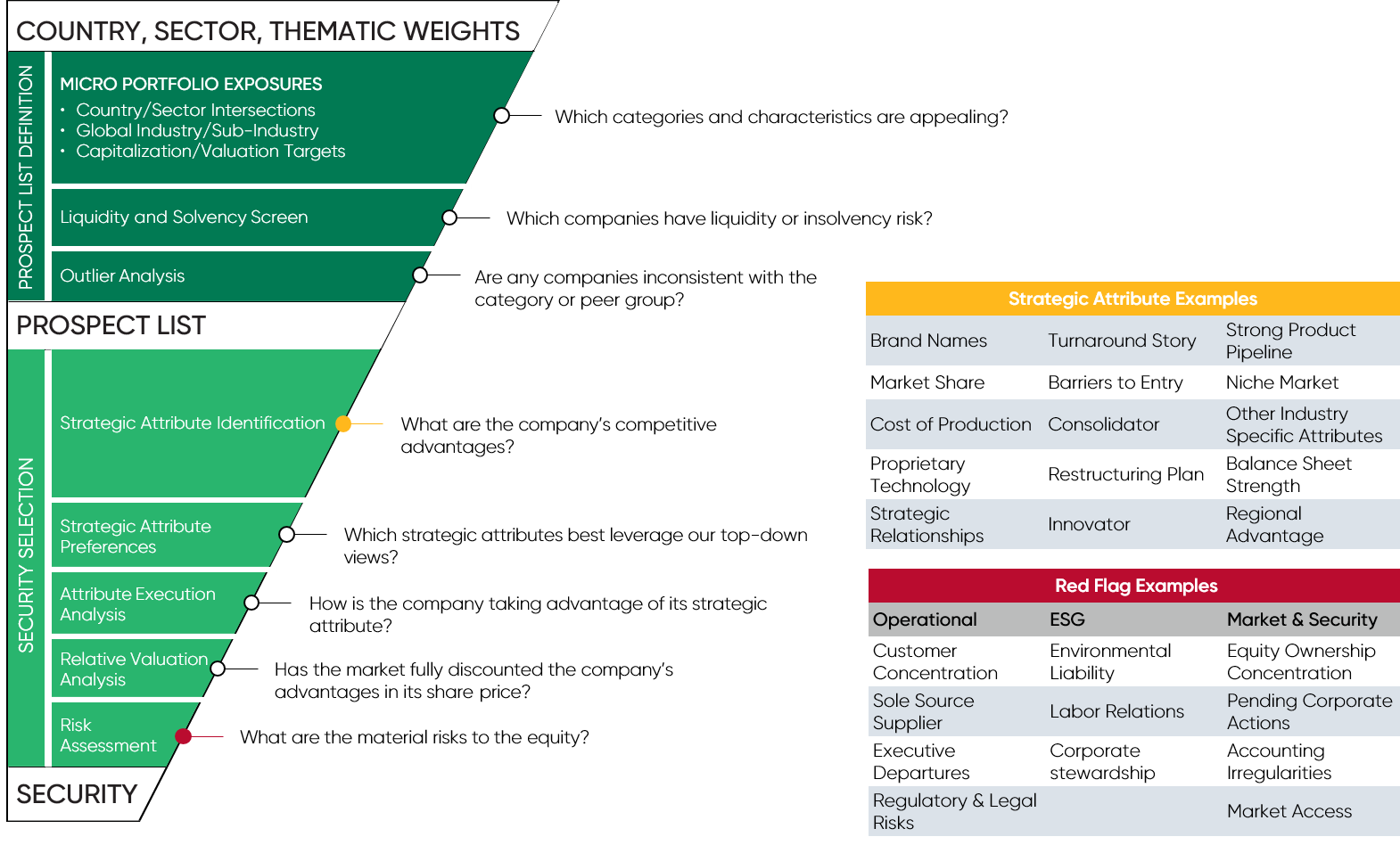

Prospect List Definition

We conduct basic quantitative screening to help minimize risk and narrow our security prospect list.

- Initially, we screen out any securities with insufficient liquidity or solvency issues.

- We then screen securities based on our macro views including valuation and/or style preferences.

- Lastly, we conduct an outlier analysis to exclude securities with categorization, pricing, business activities and/or other characteristics outside of the peer group. This step ensures we identify securities that best leverage our higher-level themes.

Strategic Attribute Identification

We seek firms with underappreciated competitive or comparative advantages relative to peers.

Security Selection

We narrow down our prospect list based upon fundamental research. Our fundamental analysis includes:

Strategic Attribute Preferences

We identify which attributes best leverage our portfolio themes.

Attribute Execution Analysis

We evaluate if the firm’s management has a cohesive, executable plan for exploiting its strategic attribute(s).

Relative Valuation Analysis

We examine current valuations relative to peers, historical trends, and the market.

Operational Risk Assessment

We analyze operational red flags to understand potential risks unrelated to valuations or day-to-day management.

From Opportunity to Reality

The opportunity set for global equities is vast. Learn how Fisher Investments distills the investment universe to build custom portfolios.