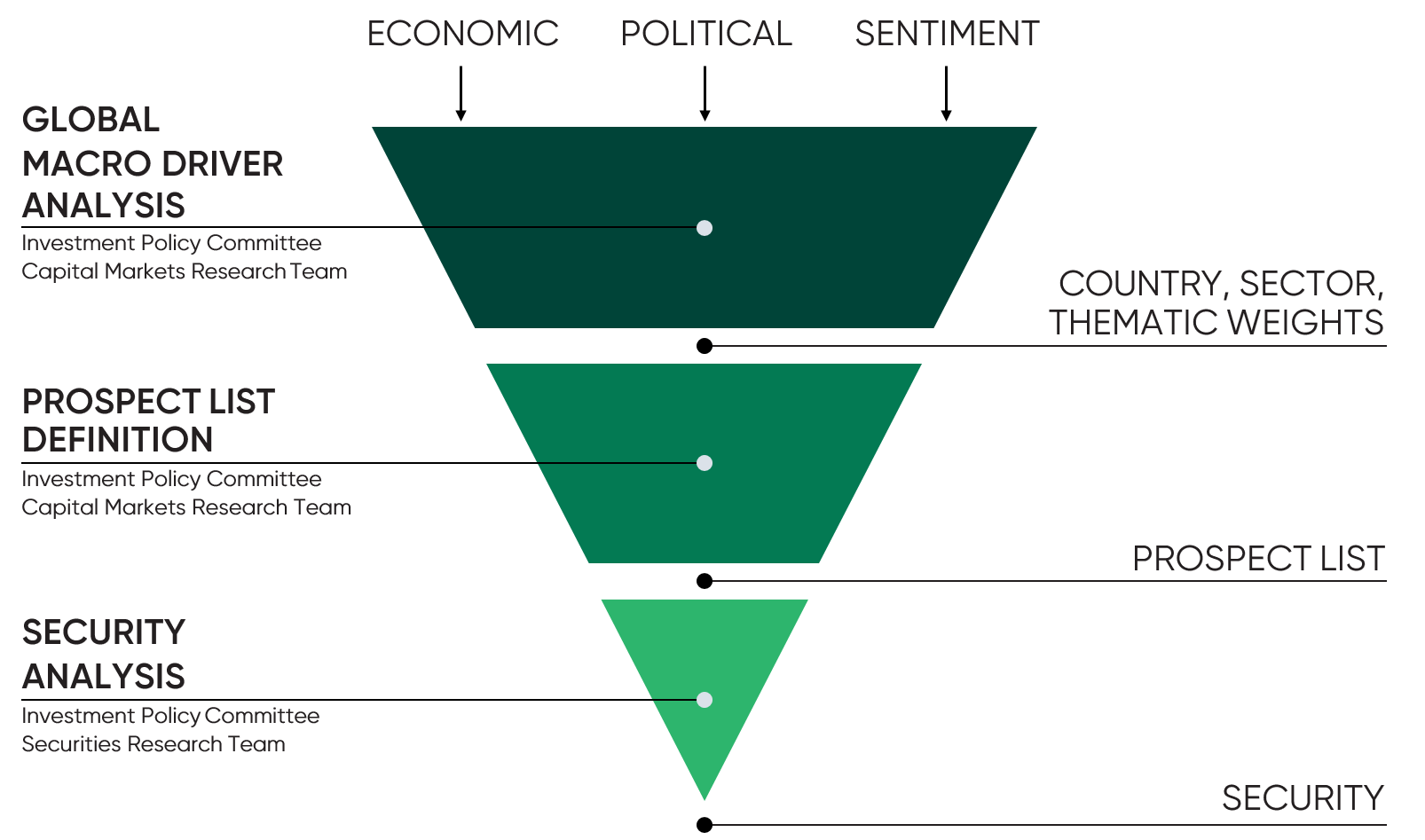

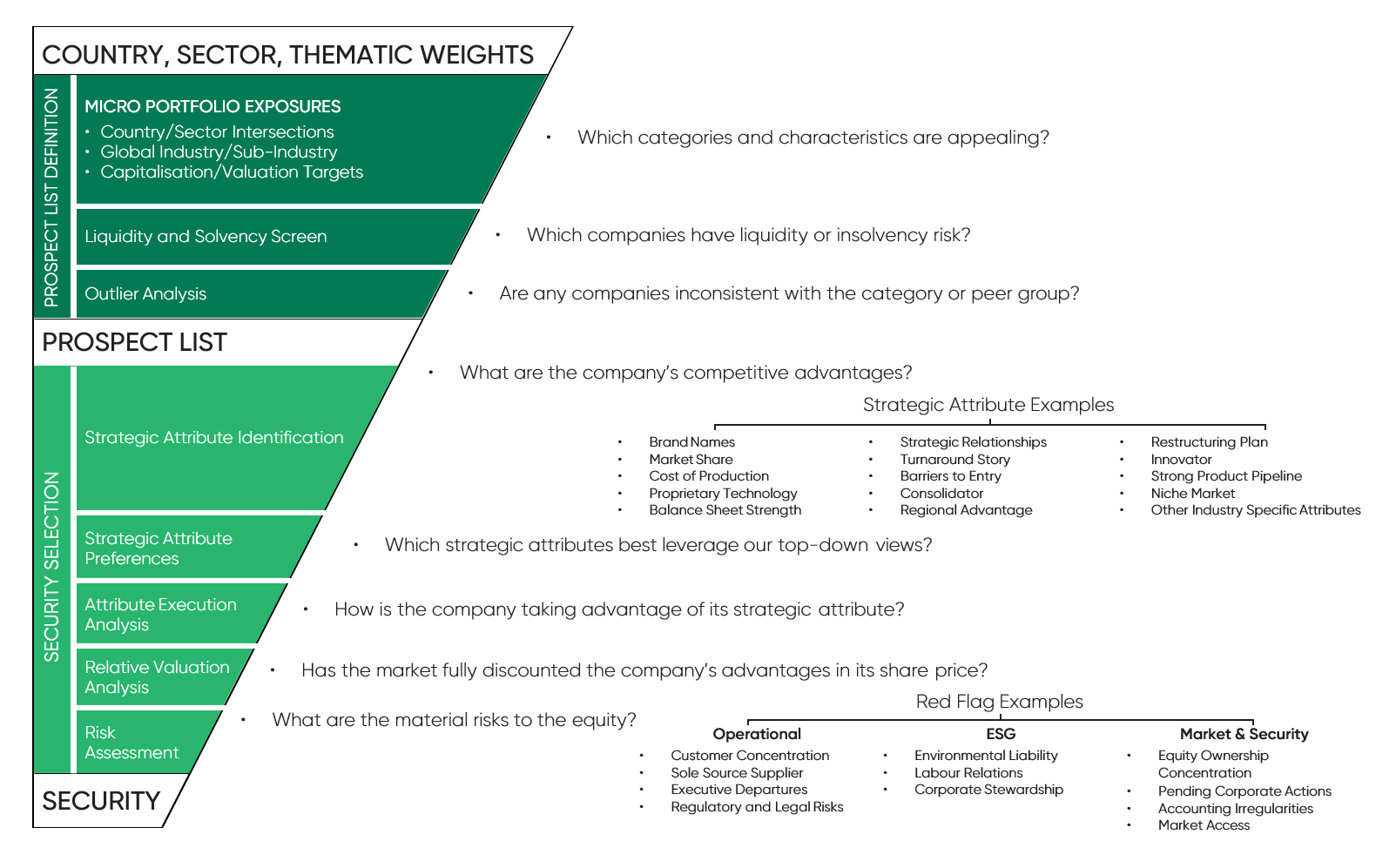

The Fisher group’s philosophical commitment to a top-down investment approach is a key advantage. The process begins with a focus on macro decisions at the country and sector/industry level, which can have a disproportionate impact on returns. Fisher Investments believes its process is uniquely suited for managing global portfolios, in contrast with the “bottom-up” approaches of many competitors who may leave key sector or country decisions as passive residuals. By actively managing these crucial higher-level decisions, Fisher Investments feels its process allows it to exploit a greater opportunity set for generating out-performance relative to other approaches. Further, Fisher Investments' security selection is specifically designed to leverage its top-down process, directly applying high-level themes from its macro analysis in its security analysis and selection. The same investment process has been consistently applied in various strategies since inception by Fisher Investments' Investment Policy Committee with excess return over the respective benchmarks in a variety of market conditions.

Fisher Investments' top-down investment process begins with a focus on macro decisions at the country and sector/industry level. By actively managing crucial higher-level decisions, Fisher Investments feels its top-down process allows it to actively exploit a greater opportunity set for generating out-performance.

Learn More

Fisher Investments' security selection process is specifically designed to leverage its top-down process, directly applying high-level themes from its macro analysis within its security analysis and selection.

Learn More

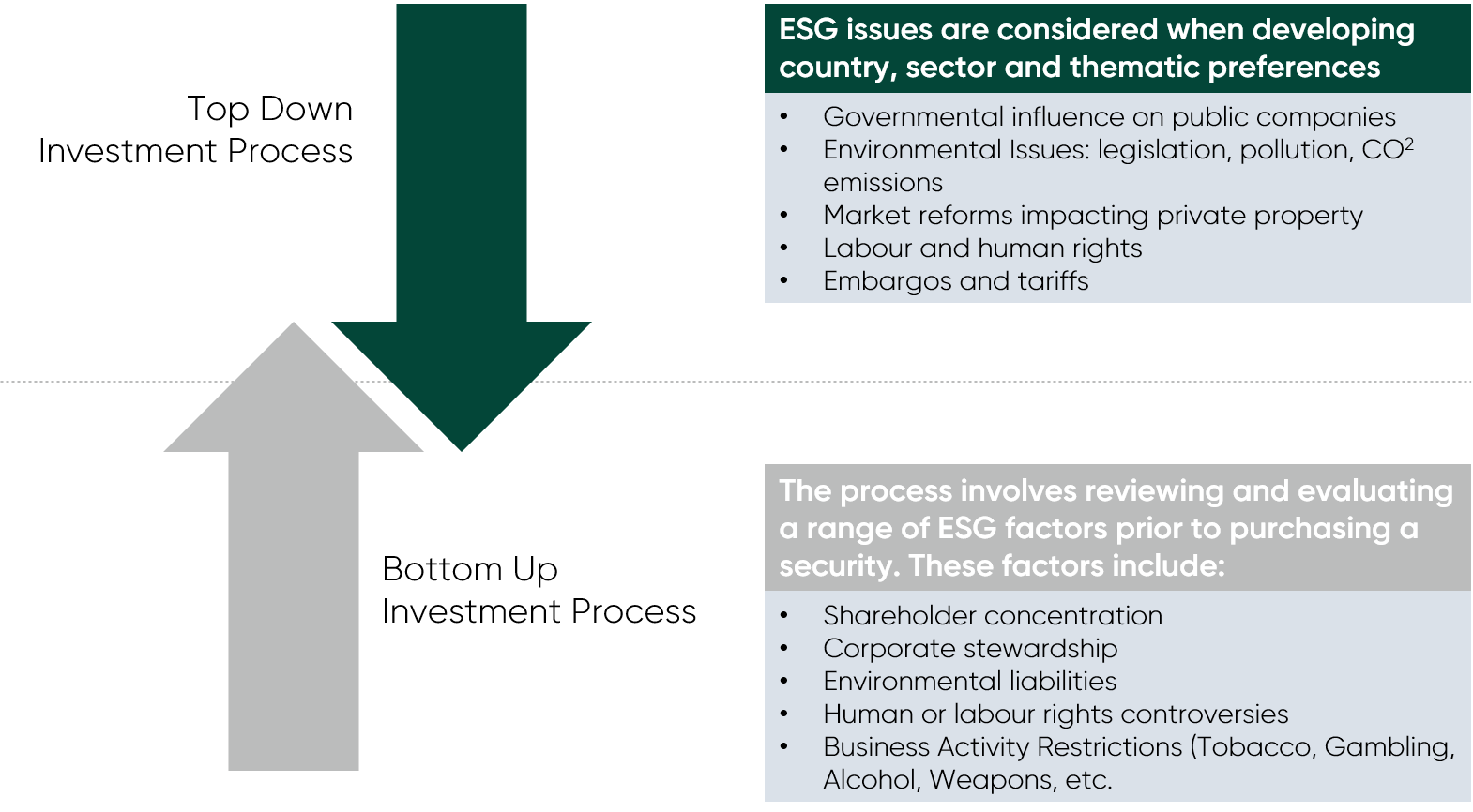

Fisher Investments considers environmental, social and governance issues in the investment and portfolio construction process. Further, Fisher Investments regularly screens and tailors its investment approach for separately managed accounts depending on any particular social and environmental guideline mandated by the client.

Learn MoreInvesting in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance neither guarantees nor reliably indicates future performance. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates.

Fisher Investments Ireland Limited, trading as Fisher Investments Europe, is authorised and regulated by the Central Bank of Ireland (CBI), and is wholly owned by Fisher Asset Management, LLC, trading as Fisher Investments (FI). Fisher Investments Europe delegates portfolio management to its parent company, FI.